Banking

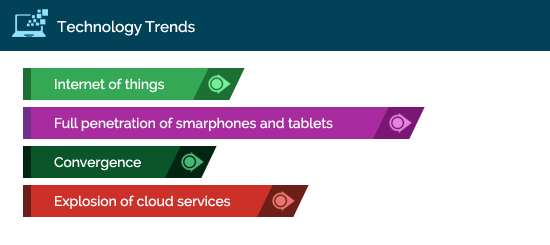

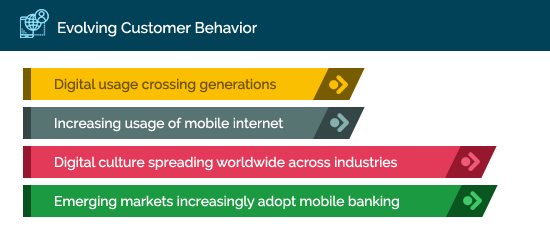

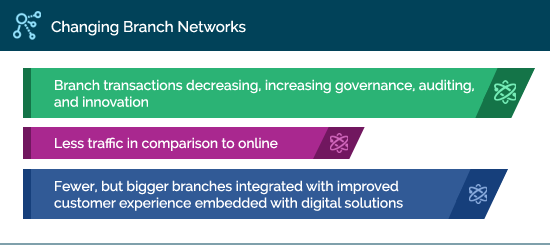

Mobile Banking – The Game Changer

Agile Operating Models

People Engagement

Finance

Put our experts to work for your IT Transformation

Expertise

Expertise to support your IT Transformation across all leading public, private, hybrid, community clouds and on-premise IT Infrastructure

Expertise to support your IT Transformation across all leading public, private, hybrid, community clouds and on-premise IT Infrastructure

Trust

Serving customers in many countries ranging from start-ups to global enterprises

Serving customers in many countries ranging from start-ups to global enterprises

Service

Guiding you through every stage of your IT Transformation, our experts will work with you, one-on-one to give the best of what you need

Choice

Helping you to adopt the choicest of technologies that will transform your business